India’s Auto parts Industry: Steady Growth Amid Global Headwind

India’s auto parts sector is gearing up for another year of solid performance, with revenue expected to grow by 7 to 9% in FY26, according to a recent report by Crisil Ratings. This growth is in line with the previous fiscal and will be mainly driven by strong domestic demand for two-wheelers (2Ws) and passenger vehicles (PVs) , especially utility vehicles. Together, these vehicle types account for nearly half of the industry’s revenue and gearing up another level.

Domestic Demand Drives Growth for auto parts

One of the biggest reasons for this optimistic forecast is the steady demand in the Indian market. The OEM (Original Equipment Manufacturer) segment, which supplies parts directly to vehicle makers, contributes around two-thirds of the total industry revenue. This segment is expected to grow by 8–9% as manufacturers increase the value of their offerings through better safety features, emission systems, and electronics — especially in modern 2Ws and PVs.

Aftermarket & Tractor Segments Steady

The aftermarket segment, which involves selling spare parts and replacements for vehicles already in use, contributes about 15% of the industry’s revenue. This segment is projected to grow steadily at 5–7%, thanks to India’s ageing vehicle population — the older the vehicle, the more maintenance it needs. Meanwhile, commercial vehicles and tractors make up about 17% of the revenue. These segments are also expected to see a moderate recovery, further supporting the overall growth outlook.

Although domestic conditions are favorable, global demand is a mixed bag. Around 60% of India’s auto component exports go to the US and Europe, and both regions are currently facing a slowdown in new vehicle sales. This includes both internal combustion engine (ICE) vehicles and electric vehicles (EVs).

Export growth is expected to slow down to 7–8%, which is still decent but lower than the previous highs. On top of that, the proposed 25% US tariff on certain imports could pose a serious challenge for Indian exporters.

Even though the US accounts for only 5% of India’s total auto component revenue, it contributes 28% to export earnings and remains the fastest-growing export market. A tariff of this size could squeeze margins for companies heavily reliant on US demand by 125–150 basis points, as there’s limited ability to pass on costs to American buyers.

Profit Margins Hold Steady with Premium Products

Despite these export-related concerns, the sector is expected to maintain stable operating margins of 12–12.5%, the same as last year. One reason is the growing share of high-margin, technology-heavy components, such as:

- ADAS (Advanced Driver Assistance Systems) modules

- Infotainment systems

- Advanced braking systems

These parts are more profitable than traditional components and now account for around 27% of revenue, compared to 18% before the pandemic. This shift is driven by the premiumisation trend and stricter emission norms, both in India and globally.

Another factor helping profitability is the drop in raw material prices, especially for:

- Steel (45–50% of input cost)

- Aluminium (15–20%)

- Plastics (10–12%)

Lower material costs help cushion the impact of other challenges, including tariffs and global uncertainty.

Strong Finances and Stable Credit Outlook

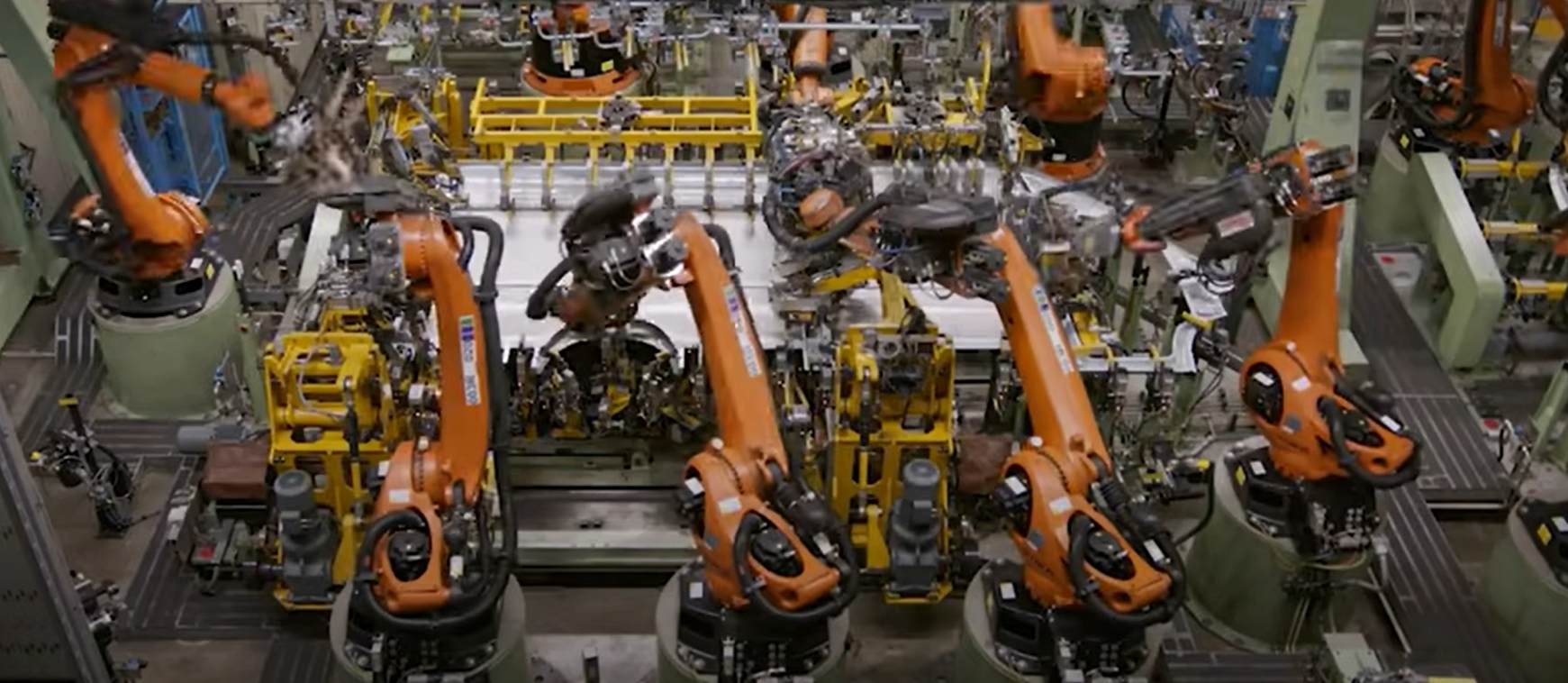

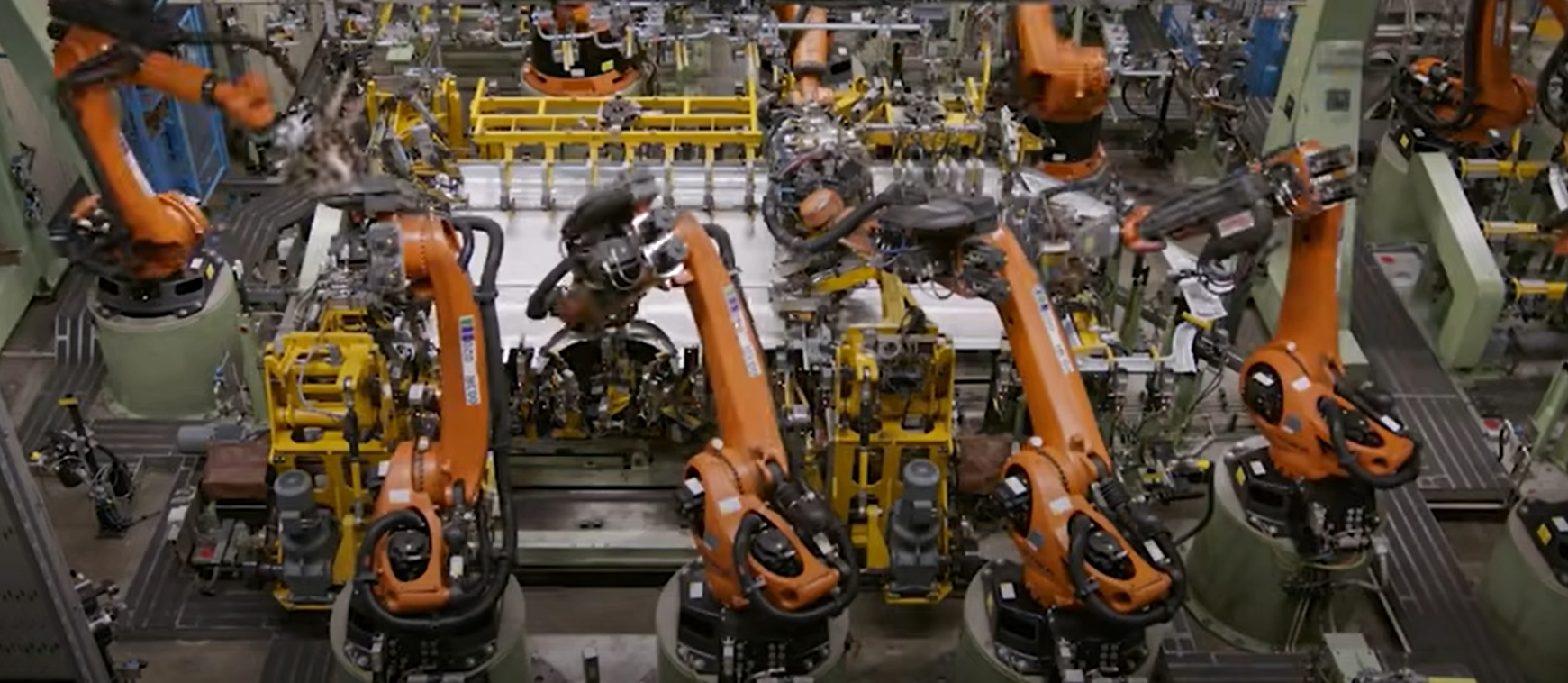

Even though companies in the sector are planning to spend around ₹22,000 crore this year on new capabilities, especially for EVs and automation, they are expected to fund most of this investment internally. This means they’ll rely on their own profits, not borrowings, which keeps their credit health stable.

Strict control over working capital — how efficiently a company manages its day-to-day operations — is another reason why the industry’s credit outlook remains positive.

Electric Vehicles: Big Plans, Small Impact (For Now)

Many companies are preparing for a shift towards electric vehicles, upgrading their manufacturing lines for EV components. But EVs still make up only about 4% of PV sales in India. So, while investments in this space are crucial for the long-term, they aren’t contributing much to current revenues.

Returns from EV investments will likely remain low in the near term, though the segment holds significant long-term promise.

Lets see how the industry react on the current growth scenario on auto parts

While the industry looks strong overall, there are a few factors that need close monitoring:

- Demand from OEMs in India

- Volatility in raw material and freight costs

- Global shifts in vehicle trends (e.g., slower EV adoption)

- Tariff changes, especially the US 25% import duty

These variables could impact how the sector performs in the months to come.

Conclusion

India’s automotive components industry is on track for steady growth in FY26, supported by robust domestic demand, especially from 2Ws and PVs, and a growing share of high-margin, tech-driven components. While export challenges, especially from the US and Europe, are real and could dent profits for some, the sector’s overall financial position remains healthy. With minimal reliance on debt and a focus on future-ready investments like EV capabilities and automation, the industry appears well-positioned to ride out global uncertainties and continue growing in the years ahead.